Should You Stay or Should You Go? Let’s Talk About That 3% Mortgage

I get it. If you’re sitting on a 3% mortgage rate, the thought of moving feels like giving up a golden ticket. I’ve had plenty of clients across DC, Maryland, and Northern Virginia ask, “Why would I give that up?” And honestly, I don’t blame them for asking. But here’s the thing, I gently remind them, most people don’t move because of their mortgage rate, they move because life changes. Needs change. Dreams evolve. So let’s flip the script for a second. Do you see yourself in your current home five years from now?

Take a moment and think about what your life will look like in 2029. Are you planning to expand your family in a Brookland craftsman? Dreaming of more outdoor space in Bowie or Fort Washington? Downsizing from your large home in Silver Spring or Fairfax as retirement nears? Or just ready for a new season somewhere that fits your lifestyle better?

If you love your home and nothing’s changing, staying put might be the right call. But if there’s even a whisper of a move on your horizon, even two, three, or five years down the line, now is the time to start the conversation.

Here’s why:

DMV Home Prices Are Expected To Keep Rising

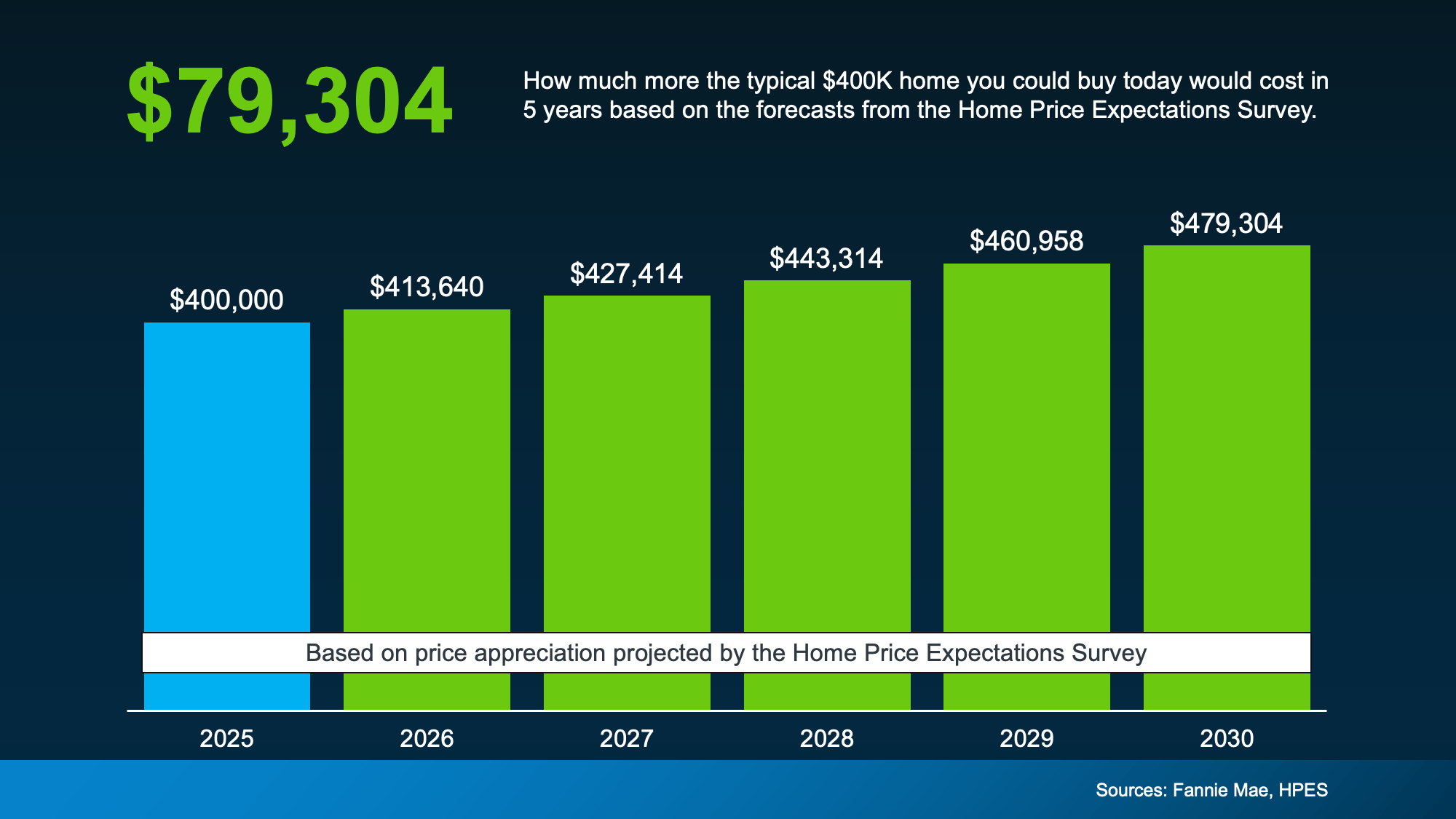

Every quarter, Fannie Mae surveys over 100 housing market experts, and the message is consistent, home prices are projected to keep climbing through at least 2029. Not massive spikes, but enough to make a dent in your budget down the line.

Let’s say you’re eyeing a $400,000 home in Prince George’s County or Northeast DC. If you wait five years? That same home could cost nearly $480,000. That’s $80,000 more just for hitting pause.

And while some markets may cool slightly in the short term, the long-term trend in the DMV is clear: values are holding strong and inching upward.

The longer you wait, the more your future home will cost you.

And About Those Interest Rates…

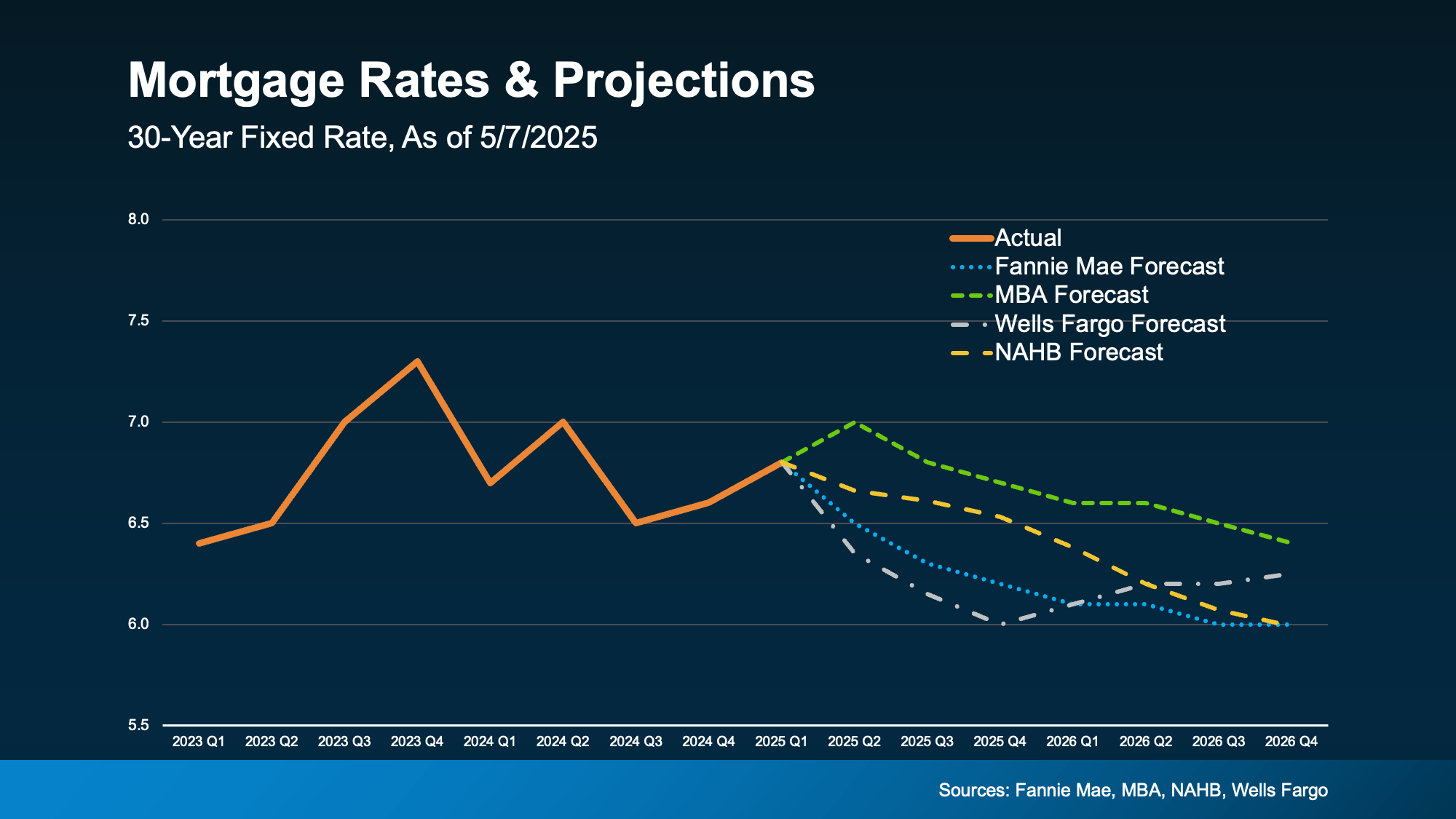

Yes, rates might dip slightly, but experts agree we’re not heading back to 3%. That chapter’s behind us. Most projections put future rates somewhere in the 5% range, a return to normal, but not the unicorn era we all got used to.

If you’re holding out in hopes we’ll see the return of 3% rates, experts agree it’s just not likely.

So the real question becomes, when should you move? Not just why. Timing matters more than ever. And if a move is even a possibility, it’s worth understanding what waiting could cost you, not just in price, but in opportunity. Especially in a competitive market like DC, where the best homes don’t stay available for long.

Bottom Line

Holding onto that low rate is smart until it starts holding you back. If you’re thinking about trading your Mount Rainier bungalow for more space in Upper Marlboro or relocating from your Adams Morgan condo to a quieter part of Montgomery County, let’s talk. I’ll break down what this could look like at your price point so you can plan with confidence and move when the time is right for you. Because informed decisions are empowered decisions. And I’m here to help you make one that aligns with your life, not just your loan.

So, are you staying because it truly serves you, or because of your interest rate? If a move might be in your future, whether it’s next season or next school year, now is the time to start planning. As a lifelong Washingtonian and real estate guide, I’m here to help you think through the numbers, your timeline, and what makes the most sense for you. Let’s connect for a no-pressure strategy session. I’ll run the numbers based on your price point, your neighborhood, and your goals so you can move forward with clarity.

Ready to talk it through?